Intel’s shares jumped more than 7% in extended trading, as the market cheered Intel's optimism about the future of its PC and server business. Intel forecasted Q4 revenue above estimates, reported Reuters.

The company has largely missed out on a boom in investments in speedy, advanced AI chips for data centers as businesses double down on adopting generative AI technology, said Reuters.

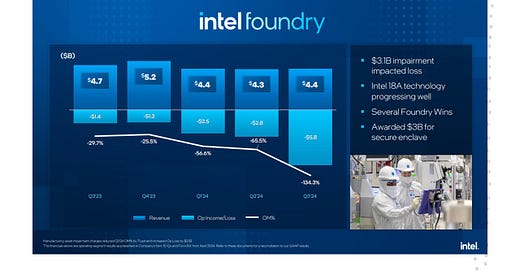

Intel reported its third-quarter earnings for the period ending September 28 on October 31, revealing deepening financial challenges despite some bright spots. Losses from Intel Foundry Services (IFS) more than doubled compared to the previous quarter, highlighting a difficult period for the company’s foundry ambitions.

IFS posted a loss of $5.8 billion in Q3, a sharp increase from the $2.8 billion loss recorded in Q2 and $1.4 billion loss posted in the same period last year. Its Q3 revenues decreased by 8%, to $4.4 billion.

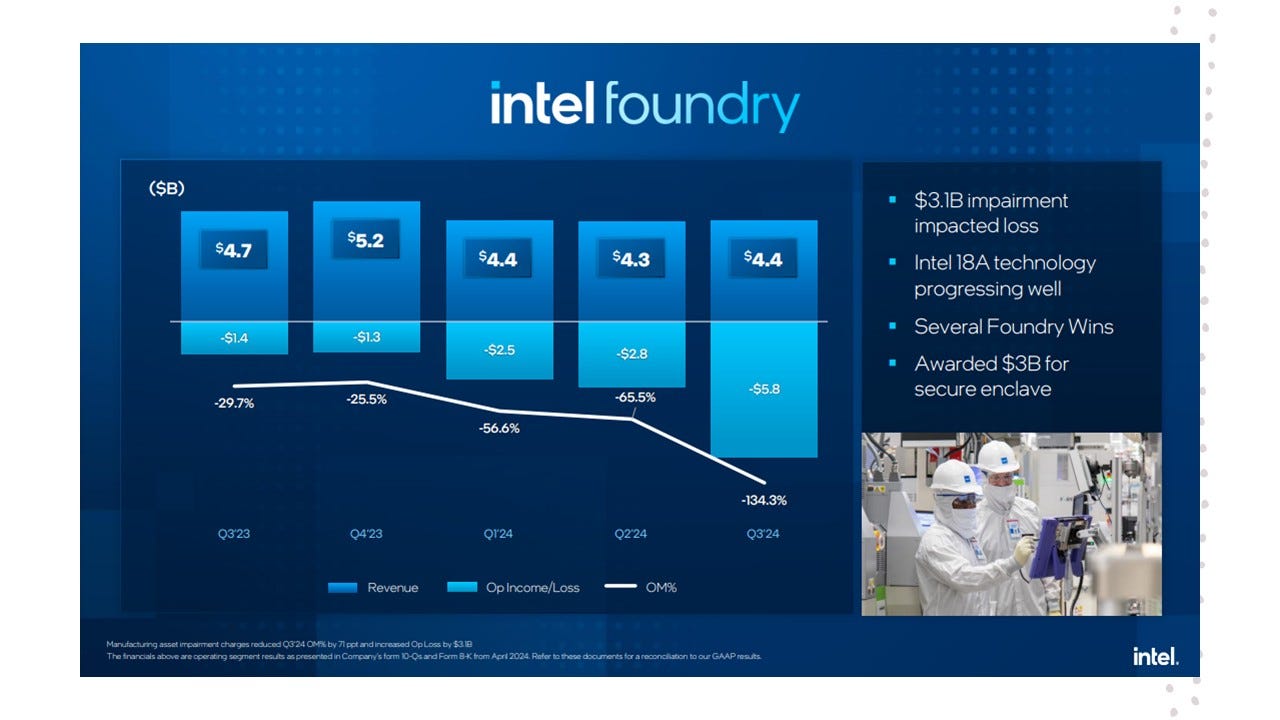

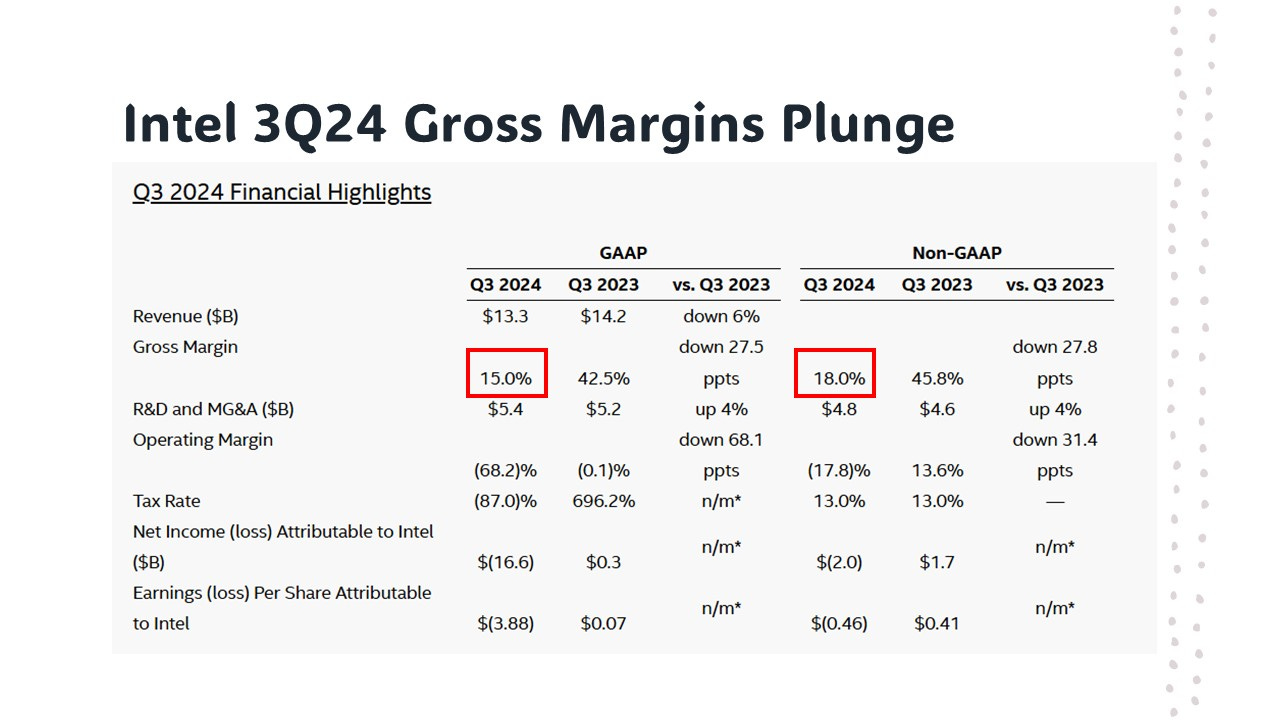

Overall, Intel's Q3 revenue saw a 6% year-over-year decline, culminating in a net loss of $16.99 billion, or $3.88 per share. This marked a stark contrast to the net earnings of $310 million, or 7 cents per share, reported in the same quarter last year.

Intel’s gross profit margins in Q3 plunged to 15% (GAAP), down from 42.5% a year ago. However, Intel forecasts a rebound to 39.5% in Q4. Intel also revealed it has reduced capital expenditures by over 20% relative to the plan at the start of the year, according to the prepared remarks of the executives. Yet its R&D and Merger and Acquisition spending still grew by 4% year-on-year, as shown in the table below.

However, there was some positive news: revenue from Intel’s Data Center and AI segment rose approximately 9% to $3.35 billion, surpassing the $3.17 billion consensus estimated by analysts polled by StreetAccount.

Although the company hinges high hopes on 18A advanced node foundry services, semiconductor analysts familiar with fab operations are questioning whether Intel can really pull it off at 18A level with satisfactory yields. “If it is already failing to do so at 3nm, and had to outsource to TSMC, I don’t think they can do better at 18A level,” said a senior semiconductor analyst affiliated with a research institute.

Andrew Lu, a retired investment bank analyst, sees the Intel report from a different angle. He wrote on his Facebook page:

“It doesn't matter if the numbers look crappy, as long as there is a one-time impairment, a restructuring loss, or an inventory impairment, the Wall Street analysts will only look at the adjusted numbers, and then do another impairment every once in a while. Should investors calculate how many times and how much this company has impaired assets in the past 5 years, and how often it might do it again in the future, and should analysts look at it as a recurring expense when it's so frequent?”

He suspects the company is painting a rosy picture of the outlook to play the market expectation on its palms:

“Is the company planning to lower the net worth of the manufacturing division quarter by quarter before dividing it, so that it doesn't have to recognize a big loss at once when it divides it at a low price and scare investors? The company's net worth in the third quarter decreased by 14% quarter on quarter, from $115.2 billion in the second quarter to $99.5 billion now. If the manufacturing division is divided and sold for $50 billion, it only needs to recognize a one-time loss of $49.5 billion now, and if it finds some reasons to knock off another $30-40 billion in the next few quarters, it will be even less to recognize the loss of the division in the future.”

In an SEC filing, Intel disclosed that on October 28, its board's audit and finance committee approved a series of cost-cutting and capital reduction measures, which include workforce reductions and real estate downsizing. The company plans to cut 16,500 jobs, exceeding the market's expectation of 15,000 layoffs. This restructuring, first announced in August, is expected to be completed by the end of the fourth quarter of 2025, as reported by CNBC.

Investors' positive reaction, evidenced by the surge in Intel's stock price, underscores a cautiously optimistic outlook. As Intel navigates these turbulent times, the upcoming quarters will be pivotal in determining whether its strategic moves and renewed focus on core areas can successfully offset the deepening losses in its foundry services. The path forward is uncertain, and Intel's ambition to reclaim its standing in the tech world remains to be tested.